This post is sponsored and paid for by SunTrust. All opinions are mine.

The new year is right around the corner and it’s the perfect time to start looking at your financial situation again (or perhaps for the first time).

SunTrust has a pretty cool experience to help you discover simple and actionable steps toward achieving financial confidence.

The onUp Challenge will help you take a step forward regardless of what you’re focused on — creating a budget, buying a home, or saving for retirement.

Here’s how to jump in and take The onUp Challenge:

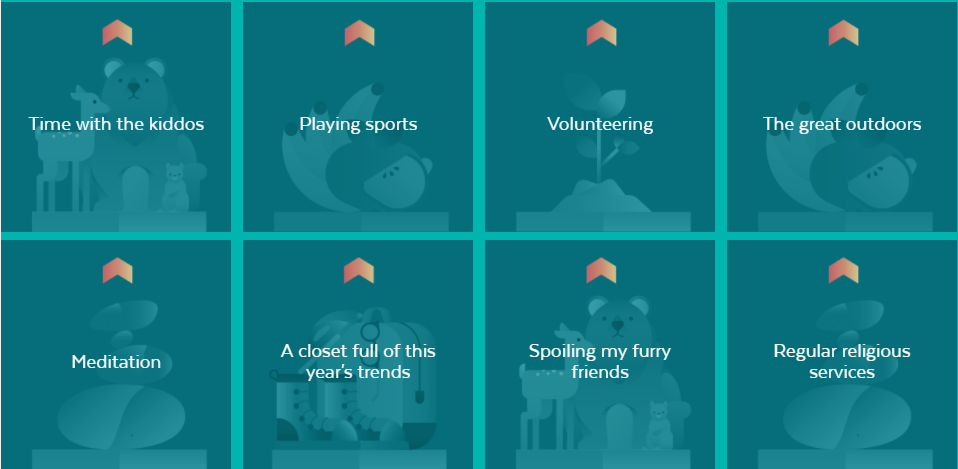

The Values Challenge — Here you’ll define what you value in life and what matters most, because the key to achieving your financial goals is to align your spending, saving, and giving with what you think is most important.

The Seven Magical Lands — Filled with advice, tools, challenges, and a checklist on specific, actionable financial topics.

SunTrust asked me to jump and try out the onUp Challenge for myself.

I started by completing the Values Challenge. I discovered that I value Family and Friends, Inner Peace & Spirituality, and Social Causes. And the challenge emphasizes that the key to achieving your financial goals is to align your finances with what matters most.

Once you have your values outlined, they can become the filter by which your financial decisions are made. So, I know that relationships are important to me so I can feel the freedom to allocate money to caring for the people most important to me.

And my spiritual life and social causes are also important which is the reason why my husband and I devote a portion of our finances and financial planning to charity.

Next, I moved on to the Magical Lands. There are seven lands in the onUp Challenge, each one building on the previous. I suggest you start at the first as it creates a solid foundation for other other disciplines.

- Start Your Savings

- Build Your Budget

- Scale Past Your Debt

- Create Your Safety Nets

- Invest For Your Future

- Manage Your Home

- Harness Your Potential

I decided to discover the fourth land — Create your safety nets.

This section covers two topics: insurance (providing financial protection for your household) and estate planning (communicating how you want your possessions (stuff and money) allocated when you die).

INSURANCE — This section has an incredibly helpful table outlining the different types of insurance out there and why you might need them. There’s also a timeline on when you should review and update your policies.

This section was especially helpful to me as we have all of our insurance set up, but I always forget to revisit the policies to make sure we are still adequately covered, are with the best companies, and are getting the best deals.

ESTATE PLANNING — This section outlines how important it is to do the work directing your loved ones on how you want your possessions and assets handled upon your death.

I love this quote: An estate plan is about order, convenience, privacy, minimizing costs and conflict, and making sure your wishes are not a burden to someone else.

So, insurance is about protecting your family now by minimizing your risk and estate planning is about protecting your family in the future by removing as much potential confusion and conflict as possible.

We already have much of our estate planning completed, but I was reminded how important it is to revisit the core elements to make sure each one is still relevant.

I really like how easy the challenges are to follow. You don’t need to be a math nerd or to understand the complexities of finances to benefit from the onUp Challenge. In fact, they have made each topic completely accessible to all of us. And the checklists and directives are simple and easy for you to act on.

When you’ve completed all the challenges, you get to create your own map to help keep you on task as you gain financial confidence.

Head to SunTrust’s onUp Challenge to start moving toward achieving your own financial confidence!

This post was sponsored, and paid for, by SunTrust. All opinions are my own.

This post may contain affiliate links. See the disclosure policy for more information.